Introduction

If you want the best budgeting expense tracker apps India 2025, this guide is perfect for you. Managing expenses and savings is easier with these expert-approved apps.

In 2025, tracking your expenses manually is like using a landline in a 5G world. With UPI, subscriptions, EMIs, and spontaneous Swiggy orders, managing your budget without a wise tool can lead to overspending and zero savings.

The solution?

A smart budgeting and expense tracking app tailored for Indian users.

In this guide, we have curated the “7 best free and paid budgeting apps in India”, handpicked by SmartGullak experts so that you can take control of your finances without spreadsheets or stress.

Our carefully selected list of the best budgeting expense tracker apps India 2025 will help you save time and money by picking the right tool.

Managing your budget effectively is key to financial success. For more ways to save and grow your money, check out our How to Save Money on a Low Income in India guide.

Why Use a Budgeting & Expense Tracker App in 2025?

As digital payments become the norm and inflation continues to shrink real incomes, a budgeting app is no longer a luxury—it is a necessity. The best apps in India today:

– Automatically track your UPI, card, and cash expenses

– Categorize your spending (food, rent, entertainment, etc.)

– Alert you when you overspend

– Help you build real financial discipline

In 2025, choosing one of the best budgeting expense tracker apps India 2025 is essential to keep your financial health in check. Whether you are a student, a freelancer, or a salaried professional, there is a budgeting app tailored to your lifestyle and income level.

Our list of best budgeting expense tracker apps India 2025 includes both free and paid options. For anyone seeking the best budgeting expense tracker apps India 2025, this guide covers all important features.

As digital payments become the norm in India, supported by government initiatives and banking reforms, managing your finances with the right app is crucial. Learn more about the growth of digital payments from the official Reserve Bank of India website.

Top 7 Budgeting & Expense Tracker Apps in India (2025)

✅ Here is our expert-reviewed collection of the best budgeting expense tracker apps India 2025 that suit different needs and budgets.

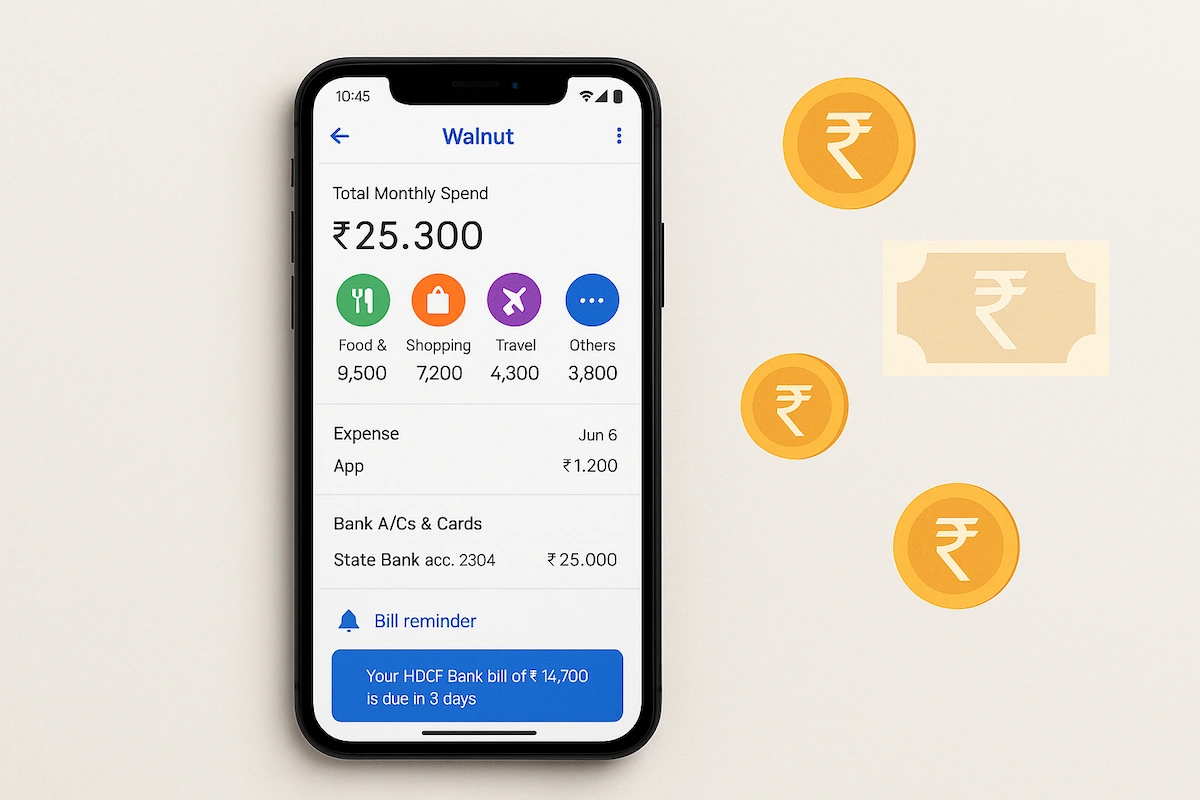

1. Walnut – India’s Go-To App for SMS-Based Expense Tracking

Platform: Android, iOS

Pricing: Free

Best For: Folks who want to track where their money is going — without handing over bank access

Features:

– Picks up your spending info straight from SMS alerts (like UPI, debit cards, credit cards)

– Sorts it all neatly into categories like food, travel, and shopping

– Reminds you when bills are due

– Gives a clear monthly breakdown of where your cash went

– Does not need the internet to keep working

Advantages:

– No need to log in or link your bank, just open and go

– Simple, light, and feels natural to use

– It is the best choice for anyone just starting to track their spending.

Walnut is one of the trusted best budgeting expense tracker apps India 2025, especially for users who prefer SMS-based tracking without linking bank accounts.

Disadvantages:

– Sometimes misreads UPI messages, especially if they are vague

– Does not show you anything about your savings or investments

SmartGullak Expert Pick:

If you want a private, low-maintenance way to keep an eye on your spending, Walnut nails it. Just set it up once, and after that, it quietly does its job in the background, no fuss.

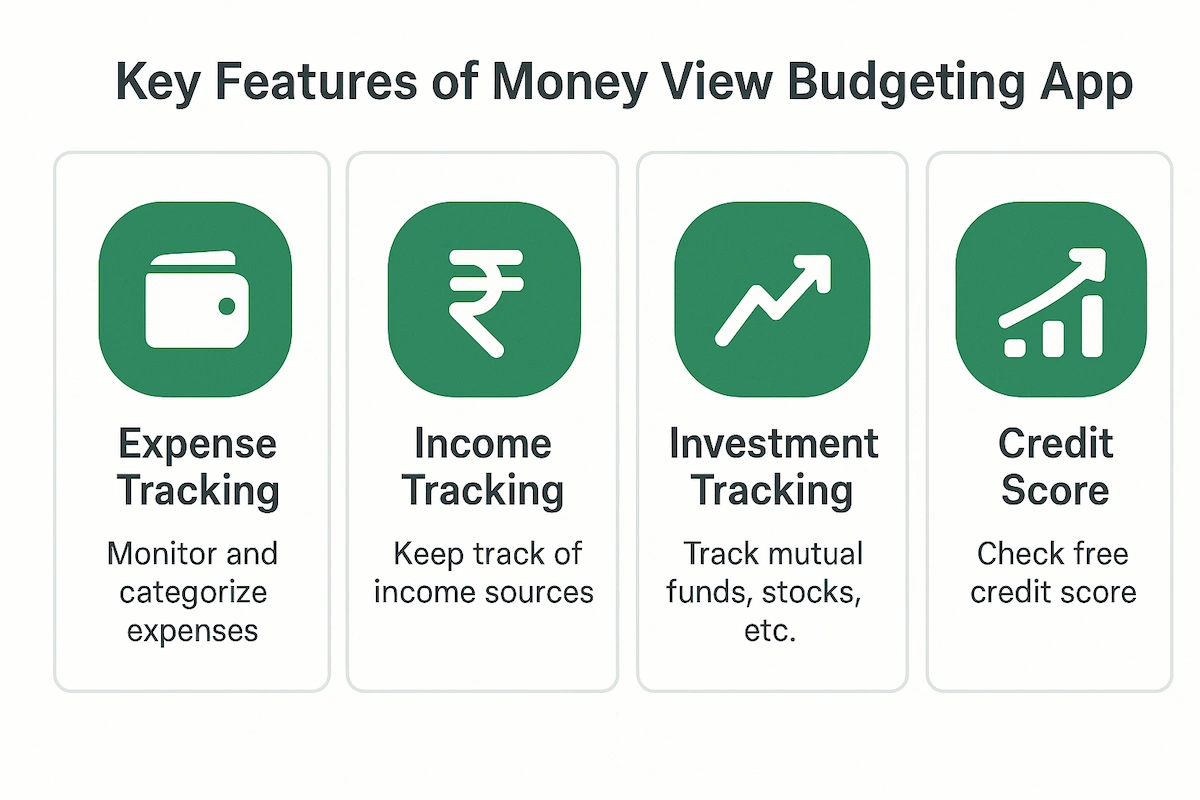

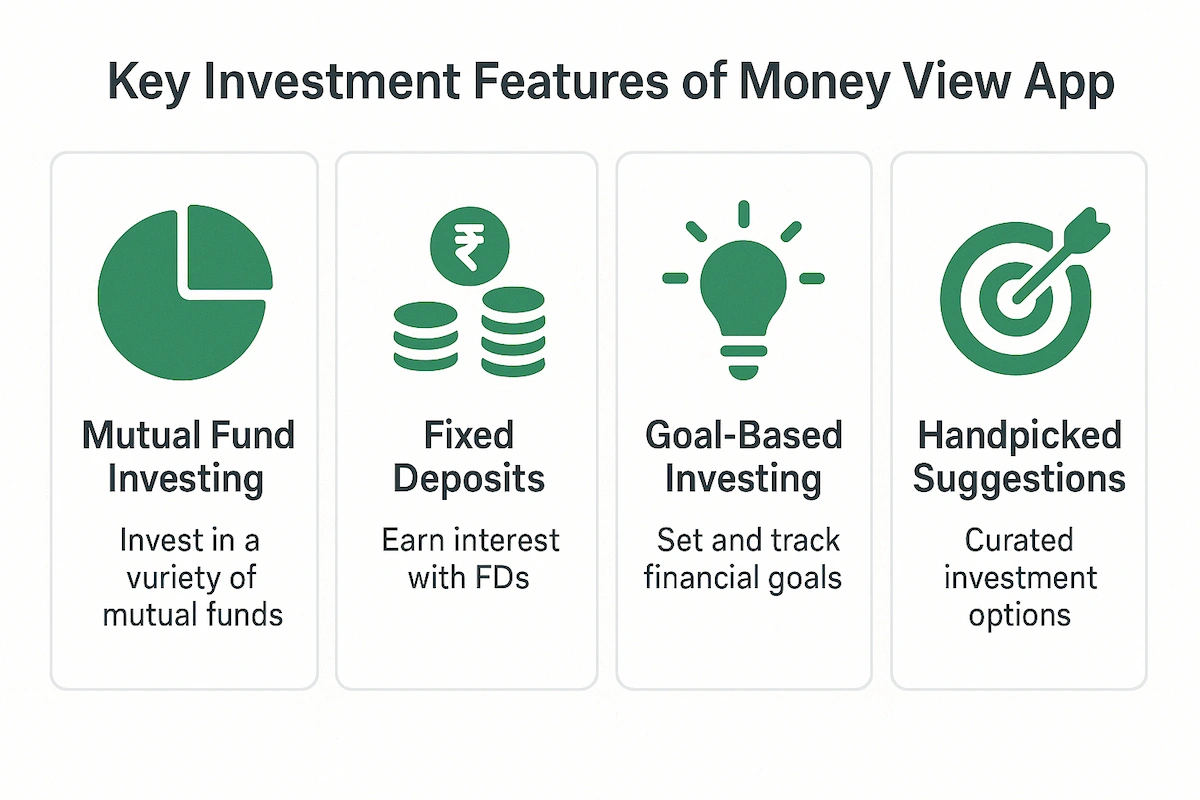

2. Money View – Budgeting Meets Credit Insights

Platform: Android, iOS

Pricing: Free (loans optional)

Best For: Working professionals who want a single app to manage expenses, EMIs, and credit health

Features:

– Automatically fetches your spending data via SMS alerts — no manual entry needed.

– Keeps your credit score accessible at a glance

– Offers personal loans if you need them, but without aggressive promotion

– Helps you build a monthly budget and set daily spending limits

– Provides a clear end-of-month summary to see where your money went

Advantages:

– Simplifies managing both credit and expenses in one place

– The user interface is clean, intuitive, and beginner-friendly

– Includes free access to your CIBIL report — a rare bonus

Money View ranks among the best budgeting expense tracker apps India 2025 thanks to its credit insights and budgeting features.

Disadvantages:

– The design occasionally leans too heavily into loan promotions

– The free version includes ads, which may occasionally distract from the experience.

SmartGullak Expert Pick:

If you’re looking for a dependable app that tracks spending and gives real-time credit insights, Money View offers a well-rounded solution.

To understand how your credit score affects your loan eligibility and financial health, visit the official CIBIL website.

It’s a smart choice for anyone who prefers managing everything in one place instead of juggling multiple finance apps.

3. Goodbudget – Envelope Budgeting for Discipline Lovers

Platform: Android, iOS, Web

Pricing: Free / Premium (₹750/month approx.)

Best For: Families and individuals following zero-based budgeting

Features:

– “Envelope system” to allocate spending before it happens

– Manual expense entry for full control

– Sync across devices

– Goal tracking for savings and debt payoff

Advantages:

– Great for intentional spending

– Family/couple friendly

– Visual budgeting structure

Disadvantages:

– No auto-sync with bank/SMS

– Premium is expensive in INR

SmartGullak Expert Pick:

If you want full control and plan-ahead discipline, this is the digital version of the old-school “gullak”.

4. ET Money – Budget + Investment + Tax Planner

Platform: Android, iOS

Pricing: Free

Best For: Investors looking to combine budgeting with wealth building

Features:

– Budget and spending insights

– Mutual fund investments, NPS, and term insurance

– Credit score & tax planner

– Easy goal tracking

Advantages:

– One-stop app for financial management

– Professional UI

– Free and ad-free

ET Money is a top contender in the best budgeting expense tracker apps India 2025 list for those wanting both budgeting and investment options.

Disadvantages:

– Slight learning curve for non-investors

– It might feel overwhelming if used only for budgeting

SmartGullak Expert Pick:

Ideal for individuals seeking to accumulate wealth while managing everyday expenses.

5. YNAB (You Need A Budget) – Premium Global Leader

Platform: Android, iOS, Web

Pricing: ₹800/month approx (after 34-day free trial)

Best For: Serious budgeters with long-term financial goals

Features:

– Zero-based budgeting system

– Syncs accounts in real-time

– Supports goals and debt payoff plans

– Educational content included

Advantages:

– Encourages habit change

– Best for detailed budget planning

– Great community support

Disadvantages:

– Expensive

– Complex for first-time users in India

SmartGullak Expert Pick:

Best for those who want to master total budgeting and are willing to invest in financial discipline.

6. Monefy – Beautiful Manual Budgeting App

Platform: Android, iOS

Pricing: Free / Pro (₹160 one-time)

Best For: Visual thinkers and first-time budgeters

Features:

– Clean pie chart dashboard

– Manual income and expense entry

– Custom categories and icons

– Fast and responsive

Advantages:

– Minimal and clutter-free

– One-time payment for Pro

– No data sharing or sync needed

Disadvantages:

– No auto-tracking

– No multi-device sync

SmartGullak Expert Pick:

Perfect for students or freelancers who want simplicity and style over automation.

7. FinArt – Made for Indian UPI + Bank Users

Platform: Android

Pricing: Free with ads / Pro (₹399/year)

Best For: Indian users tracking UPI, bank transfers, and cards

Features:

– SMS & UPI spend detection

– Auto expense categorization

– Exports to Excel/PDF

– Bank and wallet overview

Advantages:

– Super accurate Indian SMS recognition

– Affordable yearly Pro plan

– Data stays on your phone

Disadvantages:

– Android only

– No investment or goal tracking

SmartGullak Expert Pick:

A hidden gem for privacy-conscious Indian users who rely heavily on UPI.

These are the best budgeting expense tracker apps India 2025, carefully selected to suit different budgets and needs.

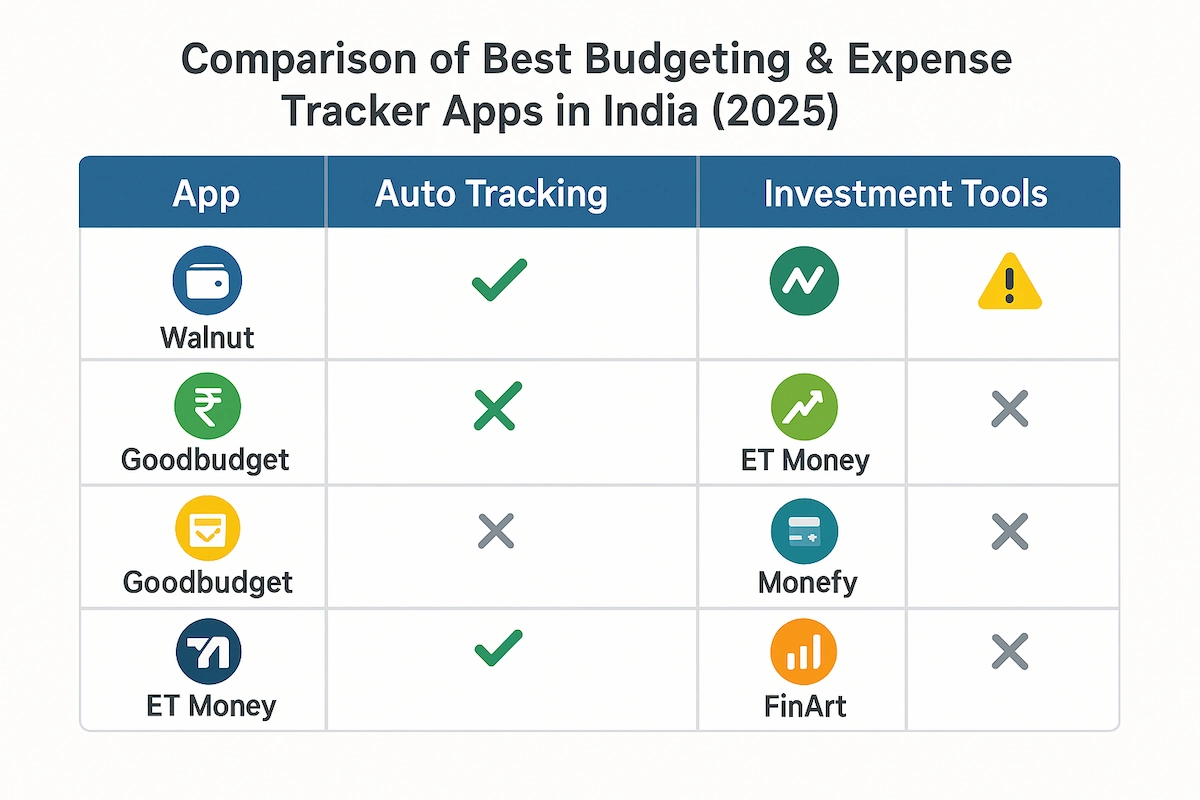

Comparison Table: Top Budgeting Apps in India (2025)

The following table compares the best budgeting expense tracker apps India 2025 by features, platforms, and pricing.

| App | Auto Tracking | Platform | Investment Tools | Free Version | Best For |

|---|---|---|---|---|---|

| Walnut | ✅ SMS-based | Android/iOS | ❌ | ✅ | Passive tracking, no bank link |

| Money View | ✅ SMS-based | Android/iOS | ⚠️ Loans only | ✅ | Credit + budget insights |

| Goodbudget | ❌ Manual | All | ❌ | ✅ / ₹750 | Zero-based budgeting |

| ET Money | ✅ Full sync | Android/iOS | ✅ Full suite | ✅ | Budget + wealth management |

| YNAB | ✅ Global sync | All | ❌ | ❌ ₹800/mo | Serious budgeters |

| Monefy | ❌ Manual | Android/iOS | ❌ | ✅ / ₹160 | Visual simplicity |

| FinArt | ✅ UPI + SMS | Android only | ❌ | ✅ / ₹399 | UPI-focused Indian users |

Exploring the best budgeting expense tracker apps India 2025 is your first step towards smarter spending and better savings.

How to Choose the Right App for YOU

Ask yourself:

– Do I prefer automation or manual control?

– Do I want investment tools too?

– Am I okay with SMS or bank sync?

– Do I need multi-device sync or offline access?

– What’s my budget for paid tools?

There’s no one-size-fits-all — pick an app that fits your habits, not the other way around. Remember, the best budgeting expense tracker apps India 2025 are the ones that fit your personal preferences and financial habits.

SmartGullak Tips to Maximize Budgeting Apps

- Review your dashboard every 3–5 days

- Set monthly limits per category

- Use “no-spend” challenges weekly

- Export your data to track real progress

- Enable alerts for credit cards and bills

A budgeting app is only as powerful as how consistently you use it. Using the best budgeting expense tracker apps India 2025 regularly ensures you build strong financial discipline over time.

Final Verdict: Which App Should You Pick?

| User Type | Recommended App(s) |

|---|---|

| Beginners | Walnut, Monefy |

| Professionals | ET Money, Money View |

| Couples/Families | Goodbudget |

| Investors | ET Money |

| Hard-core budgeters | YNAB |

| Android + UPI lovers | FinArt |

Start with any free app that aligns with your style. After a month of use, upgrade if you need more features. The goal isn’t the app—it’s your financial freedom.

Choosing from the best budgeting expense tracker apps India 2025 will help you manage your finances smarter and save more effectively. Staying consistent with any of the best budgeting expense tracker apps India 2025 can transform your financial habits and lead to long-term savings success.