Introduction

In today’s fast-paced world, it’s more important than ever to save money in India, no matter your income or lifestyle. Whether you’re a student, professional, or homemaker, knowing how to save money in India can transform your financial future. Prices of essential goods are rising, lifestyle temptations are everywhere, and digital payments make spending easier than ever. Whether you earn a modest salary or have a steady income, the real question is: how much do you actually save each month?

The truth is, financial security doesn’t come from earning more, but from spending wisely and saving consistently. Even small lifestyle changes can lead to enormous savings over time.

This guide will give you 50+ practical, actionable, and realistic tips to save money in India — whether you’re a student, working professional, or running a family household. These strategies are tailored for 2025 and beyond, combining traditional Indian money habits with modern financial tools.

By the end, you’ll know how to reduce unnecessary expenses, stretch your income further, and start building wealth without compromising your lifestyle. Even small lifestyle changes can help you save money in India every month.

1. Build the Right Money-Saving Mindset

Before diving into hacks, remember that real savings start with your mindset and the small habits you follow every day.

- Set Clear Financial Goals – Decide what you are saving for (emergency fund, travel, house, education). Goals make saving easier.

- Pay Yourself First – Save at least 10–20% of your income the moment you receive it.

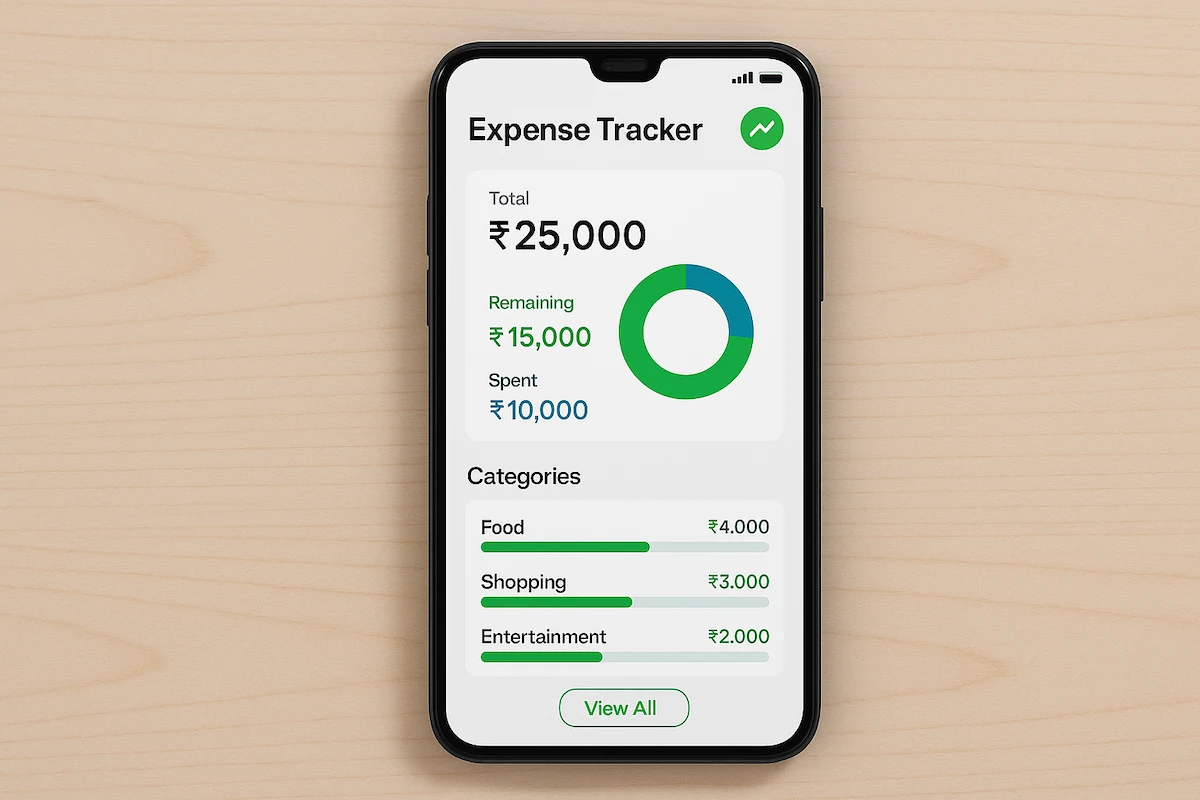

- Track Every Rupee – Use apps like Walnut, Money Manager, or a simple Excel sheet.

- Embrace Minimalism – Buy only what you truly need, not what’s trending.

- Avoid Lifestyle Inflation – Just because your salary increases doesn’t mean your expenses should.

2. Daily Life Hacks to Save Money in India

Your everyday choices have the most impact on your finances. Simple daily choices, like cooking at home or using public transport, are effective ways to save money in India without sacrificing comfort.

- Cook at Home – Make eating out a habit, and you’ll see your money disappear fast. Cooking saves both health and money.

- Carry a Water Bottle – Avoid buying packaged water during travel.

- Plan Weekly Meals – Reduces wastage and unnecessary grocery shopping.

- Use Public Transport – Metro, local trains, and buses are cheaper than cabs.

- Carpool with Friends/Colleagues – Split costs on fuel and parking.

- Buy in Bulk – Groceries, toiletries, and non-perishables are often more cost-effective when purchased in bulk.

- Switch Off Appliances – Save electricity by turning off fans, AC, and lights when not in use.

- Use Energy-Efficient Devices – LED bulbs and inverter-based appliances lower long-term costs.

- Limit Online Food Orders – Save them for occasional treats.

- Reuse and recycle – Don’t replace items unnecessarily.

3. Smart Shopping Tips to Save Money in India

- Compare Prices Online – Check apps like PriceDekho or Google Shopping before making a purchase.

- Wait for Sales – Sales during Republic Day, Diwali, and Independence Day bring huge discounts.

- Avoid Impulse Buying – Add items to a wishlist; buy only if you still want them after 7 days.

- Use Cashback & Rewards Apps – Paytm, Cred, and Amazon Pay often offer rewards.

- Buy Quality, Not Quantity – A good pair of shoes lasts longer than three cheap ones.

- Use Credit Cards Wisely – Only if you pay bills on time to avoid interest.

- Avoid Extended Warranties – Most are unnecessary.

- Borrow Instead of Buying – Books, tools, or outfits for one-time use.

- Opt for Generic Brands – Medicine and daily items often have cheaper alternatives.

4. Digital Tools & Money Apps

Technology can make saving money effortless. Using budgeting apps can make it easier than ever to save money in India efficiently and track your progress.

- Budgeting Apps – Walnut, Money View, ET Money.

- UPI Payments – Helps track expenses and sometimes offers cashback.

- Subscriptions Tracker – Cancel unused OTT or gym memberships.

- Use Splitwise for Shared Costs – Avoid awkward money situations with friends.

- Expense Reminder Apps – No late fees on bills.

5. Saving on Food & Groceries

- Buy Seasonal Fruits & Vegetables – Cheaper and healthier.

- Visit Wholesale Markets – Mandis are much cheaper than supermarkets.

- Use Online Grocery Discounts – BigBasket, Blinkit, Zepto.

- Avoid Packaged Foods – They’re more expensive and not as healthy.

- Cook in Batches – Saves time, energy, and money.

6. Student-Specific Money Hacks

- Use Student Discounts – Transport, software, courses, and even restaurants.

- Borrow or Rent Books – Don’t buy new unless necessary.

- Make use of free online learning platforms – Coursera, Khan Academy, and YouTube.

- Share Hostels/PG Rooms – Splitting the rent with others makes it much more affordable.

- Apply for Scholarships – Many colleges in India offer scholarships based on merit or financial need.

7. Money-Saving Tips for Professionals

- Maximize Tax-Saving Investments – ELSS, PPF, NPS.

- Pick cost-effective ways to commute – Monthly train or metro passes.

- Bring Lunch from Home – Healthier and cheaper.

- Claim Office Allowances – Phone bills, internet, or travel reimbursements.

- Use Office Perks – Complimentary coffee, snacks, and resources available.

8. Family & Household Money Hacks

- Opt for used furniture – OLX, Quikr, or local markets.

- Switch to solar water heaters – it helps you save on energy in the long run.

- Cut Down on Subscriptions – Share Netflix/Prime accounts within the family.

- Plan Family Vacations in Advance – Book your trains, flights, and hotels in advance.

- Do DIY Repairs – Minor fixes can save you on service costs.

- Organize Celebrations at Home – Instead of expensive banquets.

9. Long-Term Financial Strategies

Starting early with SIPs, PPF, and recurring deposits helps you consistently save money in India and build financial security.

- Build an Emergency Fund – At least 6 months of expenses.

- Automate Savings – Fixed deposits, recurring deposits, or SIPs.

- Start Investing Early – Even ₹500/month in mutual funds can grow big.

- Avoid Debt Traps – Don’t fall for unnecessary EMIs.

- Buy Insurance Early – Health and term insurance save money in emergencies.

- Plan Retirement Early – Small savings now mean financial freedom later.

Conclusion

Saving money in India is not about being miserly — It’s all about spending wisely and with intention. By applying even a few of the 50+ tips from this guide, you can see a visible difference in your monthly savings. Implement these tips today and see how you can start to save money in India while still enjoying life.

Remember: Consistency beats intensity. Don’t try to change everything overnight. Start small—try cooking more at home, tracking your expenses, or canceling a subscription. Over time, these small steps will add up to great financial wins.

At SmartGullak, we believe every rupee saved is a rupee earned — and when invested wisely, it’s a rupee multiplied. By applying these 50+ strategies, anyone can consistently save money in India and achieve financial security, no matter their income level.

Fantastic tips! Really practical ways to save money in India.